Introduction:

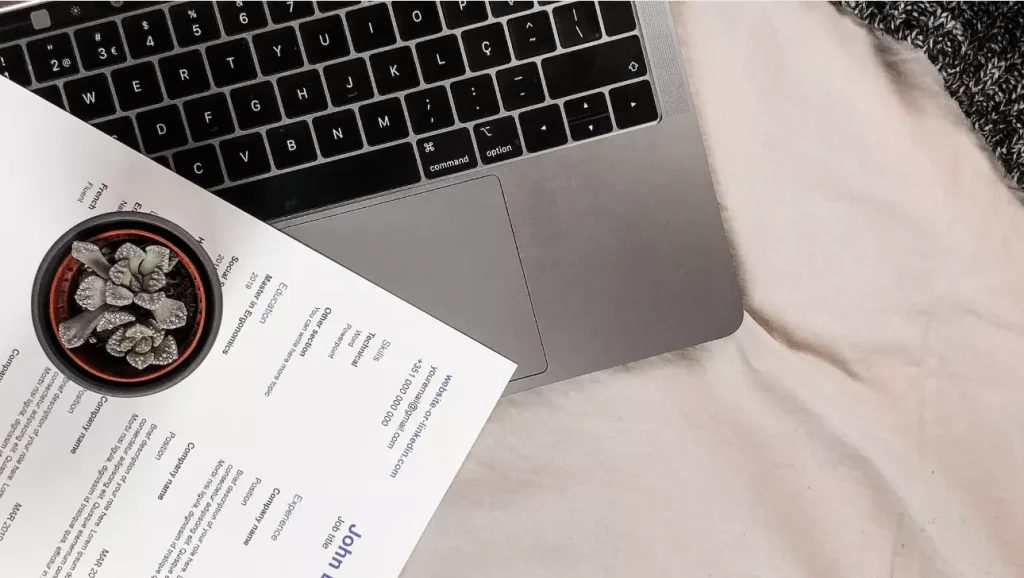

Building a strong resume is crucial when pursuing a career in financial services and banking. With competition for these highly sought-after positions increasing, a well-crafted resume can make a significant difference in capturing the attention of employers. In this blog, we will explore the important elements of resume building for financial services and banking careers. Whether you are an experienced professional or a recent graduate, these tips and insights will help you create a resume that stands out from the crowd.

FAQs about Resume Building for Financial Services and Banking Careers:

1. What information should I include in my resume?

Your resume should include your contact information, professional summary, work experience, education, skills, certifications, and any relevant achievements or awards.

2. How should I format my resume?

A professional and clean format is key. Use a standard font, keep the layout consistent, and make sure the content is easy to read. Chronological or combination formats are often preferred for finance and banking resumes.

3. Should I include a career objective?

While a career objective used to be the norm, it is now more common to include a professional summary at the beginning of your resume. This allows you to quickly highlight your experience, skills, and goals.

4. How important is relevant work experience?

Relevant work experience is highly valuable in financial services and banking. Include any internships, part-time jobs, or volunteer work that demonstrates your skills and knowledge in this field.

5. What if I have limited work experience?

If you lack extensive work experience, focus on highlighting relevant coursework, projects, or extracurricular activities that showcase your abilities and dedication to the industry.

6. Should I include references on my resume?

References can be a separate document or provided upon request. Including them on your resume is unnecessary and takes up valuable space. Instead, you can mention that references are available upon request.

7. How important are certifications and licenses?

Certifications and licenses are highly regarded in the financial services and banking industry. Include any relevant credentials you have obtained, such as a Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) designation.

8. Are keywords important in a finance resume?

Yes, keywords are critical in resumes for financial services and banking careers. Tailor your resume to match job descriptions and include industry-specific terms. This will demonstrate your knowledge and familiarity with the field.

9. Should I focus on quantitative achievements?

Quantitative achievements, such as increasing revenue or reducing costs, are particularly valuable in finance and banking resumes. Use numbers and percentages to showcase your accomplishments.

10. Should I have someone review my resume?

Absolutely! Seeking feedback from professionals or mentors in the industry can provide valuable insights. Their guidance can help you identify areas for improvement and ensure your resume is competitive.

Conclusion:

Building an outstanding resume is essential for success in financial services and banking careers. By including the right information, formatting it professionally, and emphasizing your relevant work experience and achievements, you can create a resume that catches the attention of employers. Remember to tailor your resume to each job application, utilize industry-specific keywords, and seek feedback from professionals in the field. With a well-crafted resume, you can greatly increase your chances of landing the position you desire in the financial services and banking industry.